Game-Changing

Crypto Arbitrage Trading

Experience a new dimension of arbitrage trading with Arbitrons, an innovative product brought to you by Binary Guardian.

Powered by state-of-the-art Artificial Intelligence technology, Arbitrons is designed to be your ultimate trading partner in

the ever-evolving crypto marketplace. We have engineered a system that thrives in the fast-paced world of digital currency,

addressing the multifaceted challenges of arbitrage trading head-on.

Boasting over a decade of experience, our elite team at Binary Guardian has harnessed their expertise to create a tool

that revolutionizes the way traders engage with the market. Quick to identify and act on arbitrage opportunities, Arbitrons

ensures trades are executed at the most opportune moments, maximizing your potential profits. Regardless of market volatility,

our system remains resilient and effective, always aiming for optimal profitability.

Not just that, but Arbitrons also distinguishes itself from traditional arbitrage systems through its adaptable nature.

Our AI-powered platform is designed to seamlessly transition between various trading and arbitrage strategies, responding

to market fluctuations with agility and precision.

Experience a new standard of arbitrage trading, where strategy optimization and outcome maximization are the top priorities.

Arbitrons: The Best Platform for Traders Worldwide

Advanced AI and machine learning for trade execution in milliseconds

Real-time market data for profitable opprtunities

Strong security measures for funds and personal information protection

User-friendly interface for easy navigation and trading

Redefining Arbitrage Trading

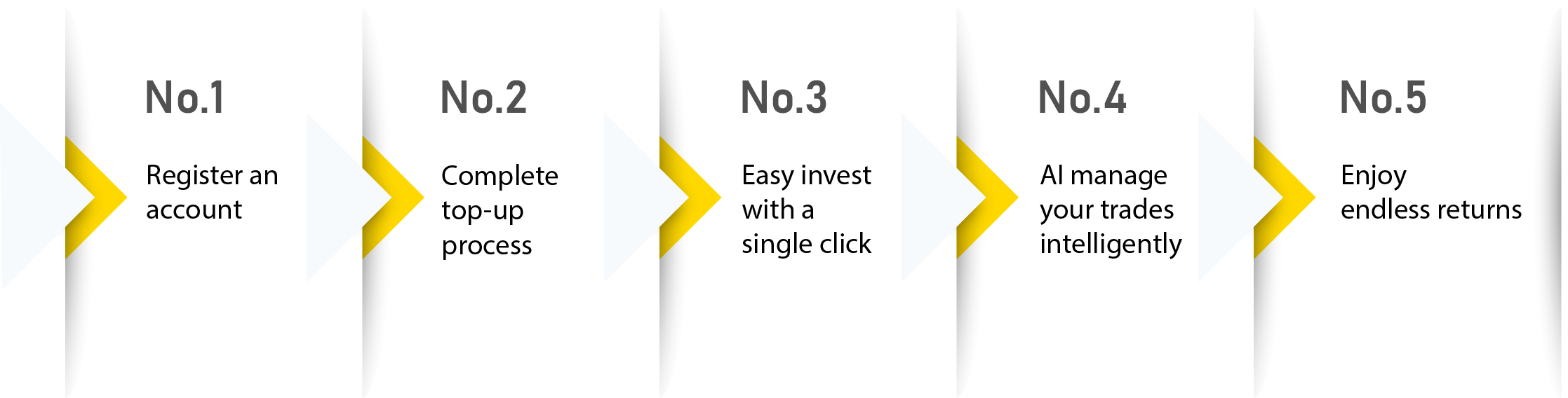

5 Steps to High Returns with Arbitrons

Guide to Arbitrage Trading

What is Arbitrage Trading?

Arbitrage trading is a strategy that traders use to take advantage of price differences of the same asset in

different markets. The principle behind arbitrage trading is relatively simple:

buy low in one market and

sell high in another.

These price discrepancies can occur for several reasons such as variations in supply and demand, market

inefficiencies, or differences in the quality of information available to market participants. In the

world of crypto, the price of a particular cryptocurrency might vary slightly between exchanges due to

factors such as local demand and supply, transaction volumes, or liquidity levels.

For instance, consider a hypothetical situation where Bitcoin is trading at $30,100 on Binance, but it

is trading at $30,105 on another exchange. An arbitrage trader could buy Bitcoin for $30,100 on Binance

and then immediately sell it for $30,105 on the second exchange, making a $5 profit per Bitcoin minus any

transaction or operational costs.

It is important to note that arbitrage opportunities usually last for a very short period

(sometimes only a few seconds), as the prices in different markets quickly adjust to eliminate

the discrepancy. Therefore, arbitrage trading often requires advanced trading systems that can

execute trades quickly and automatically.

Despite these challenges, many traders, particularly those using Arbitrons’s automated trading solution, can successfully employ arbitrage strategies to achieve consistent returns.

Traditional Pain Points of Arbitrage

- High Barriers to Entry: High initial capital is often required for successful arbitrage trading. The price differences between different markets might be small, thus substantial sums may be needed to make trades profitable after deducting transaction costs.

- Liquidity Risk: Some arbitrage strategies might involve assets that are not very liquid. Buying or selling large quantities of such assets can lead to significant price slippage, thereby reducing potential profit or even leading to losses.

- Speed and Efficiency: Arbitrage opportunities often disappear in a matter of seconds as market participants correct price inefficiencies. High-speed trading algorithms are usually required to take advantage of these fleeting opportunities.

- Operational Risk: Arbitrage strategies can be complex and require proper infrastructure and management to ensure that everything operates smoothly. Errors in trade execution, system failure, or even human errors can lead to significant losses.

Features

With an unyielding commitment to innovation and precision, Arbitrons aims to be the new frontier in optimized arbitrage performance.

Arbitrons boasts a plethora of features, meticulously designed to revolutionize your trading experience. High-speed execution is at the core, ensuring that the platform acts quickly to seize arbitrage opportunities as they emerge. Our system is geared to handle minute market fluctuations and sweeping changes alike, always aiming for timely and precise trade execution.

Global

Liquidity Pool

The Arbitrons platform is committed to optimizing capital management and utilization for our traders. To achieve this, we have established a global liquidity pool - a feature that streamlines trading activities and ensures our traders are always ready to seize arbitrage opportunities. This pool, situated across major exchanges worldwide, acts as the beating heart of our arbitrage operations.

By strategically placing assets within this liquidity pool, we ensure that these funds are readily available and can be swiftly deployed for arbitrage activities across various exchanges. The result is a solution that revolutionizes the way trades are executed, ultimately delivering you faster and more profitable trading experiences.

Our intelligent algorithms are the backbone of this system. They continuously monitor and identify arbitrage opportunities across diverse exchanges, automating the entire process to act instantly. This ingenious solution addresses the challenge of inter-exchange trading latency effectively, allowing you to generate profits with unparalleled speed.

Real-Time

Data Analysis

Stepping into the future of trading, the Arbitrons system is equipped with real-time data processing capabilities. This key feature is the lifeblood of effective arbitrage, as it empowers our traders to analyze transactions instantaneously and spot asset price disparities across various markets. By utilizing real-time data analysis, we significantly shorten the decision-making process in the fast-paced and ever-evolving world of arbitrage trading.

Harnessing the power of sophisticated algorithms, Arbitrons system meticulously examines the multi-dimensional market data in real-time. The insightful results derived from this analysis drive the system to act promptly on arbitrage opportunities as they arise, offering you an undeniable edge in the market. Our approach to data analysis not only accelerates your trading decision process but also improves the efficiency of your trading strategies, ultimately maximizing your profit potential.

Speedy

Automated Trading

Arbitrons prides itself on a system powered by cutting-edge artificial intelligence. This AI technology is the driving force behind our fast and precise automated trading - a quintessential feature for effective arbitrage. By continuously monitoring market dynamics and price disparities, our AI system is quick to act, executing trades at the optimal moments to capitalize on fleeting arbitrage opportunities.

With Arbitrons, you gain access to a system that learns, adapts, and reacts to market movements on its own. Its machine-learning capabilities enable it to recognize patterns and forecast potential arbitrage opportunities. This ensures that every trade is not only executed at the best possible moment but is also tailored to deliver the most lucrative outcome.

Global Trade

Execution Centres

In a bid to further optimize your trading experience and profitability, Arbitrons adopts a unique approach to order execution. Our innovative platform segments large trade orders into smaller, more manageable portions, ensuring a seamless trading process. This strategy effectively mitigates the risk of slippage, a common setback associated with substantial trades, and maximizes profits.

Arbitrons' global trade execution centres employ the order-splitting strategy in response to the varying trading speeds and liquidity levels across different exchanges. By executing trades in well-structured batches, we minimize slippage risk and enhance overall trading efficiency. In addition, this process allows for better adaptation to sudden market shifts, ensuring that your trading strategies remain unimpeded and profitable in a variety of market conditions.

Partnerships with

Multiple Exchanges

A cornerstone of Arbitrons' comprehensive approach to arbitrage trading is the establishment of partnerships with multiple exchanges globally. These collaborations not only enrich our trading platform but also equip our traders with a versatile arsenal to conquer the challenges of the crypto market.

In the face of potential delays on one exchange, Arbitrons' partnerships enable us to switch swiftly to an alternative exchange, thus guaranteeing uninterrupted trading. This flexibility enhances execution efficiency, and more importantly, it safeguards your trading activities from unforeseen market disruptions. With Arbitrons, you can confidently navigate the volatile cryptocurrency landscape, knowing that our robust partnerships and agile system stand ready to optimize your trading experience.

Roadmap

Pioneering the Future of Arbitrage Trading

- Product Innovation: Introduce advanced features to our system, focusing on new risk management capabilities and unique trading strategies.

- Blockchain Integration: Explore the integration of new blockchain technologies to improve system security and provide transparent trading operations.

- Algorithmic Advancements: Advance our trading algorithms to stay at the cutting edge of market predictions and optimize trading strategies.

- User Experience: Revamp the user interface and improve the user experience of our system, making it even more intuitive and trader-friendly.

- Regulatory Compliance: Work closely with financial regulators in our markets to ensure our operations are compliant and that we are prepared for upcoming regulations.

- Securing New Partnerships: Continue securing partnerships with more exchanges to ensure that our traders can better seize arbitrage opportunities throughout the crypto markets.

- Sustainability Reporting: Begin publishing regular sustainability reports, outlining our efforts to address environmental, social, and governance (ESG) issues in our operations.

- Trading Education: Develop a comprehensive educational platform offering webinars, tutorials, and resources to help traders master arbitrage trading.

- AI Research Lab: Establish a dedicated AI research lab to pioneer next-generation AI technologies for arbitrage trading.

- Product Enhancement: Upgrade our system with advanced features, tools, and strategies tailored to the evolving needs of our traders.

- Market Expansion: Strengthen our brand identity through targeted marketing strategies and initiatives to expand into key crypto markets.

- IPO Preparation: Begin preparations for an initial public offering (IPO) to raise capital for further expansion and product development.